Time to Review Your Medicare Prescription Coverage!

Betty Chaffee/ October 19, 2023/ Health insurance, Medicare, Medication Management, prescription drug costs/ 0 comments

It’s the annual open enrollment season for Medicare once again! Open enrollment started October 15th and runs through December 7th. This is a perfect opportunity to think carefully about whether your prescription coverage still meets your needs.

I’ll go out on a limb here and say that searching for the best insurance policy (whether it’s home, auto, health, or prescriptions) probably isn’t your favorite pastime. I’ll confess it’s not mine. But if you found yourself perplexed about your prescription costs this year, you might want to do it anyway. Did you have deductibles you weren’t prepared for? A new medication with a crazy-high copay? Maybe you reached the “donut hole” (coverage gap) unexpectedly. Or had one of your meds changed to a higher tier. All of these are good reasons to take another look at available prescription plans to see if there’s one with a better fit.

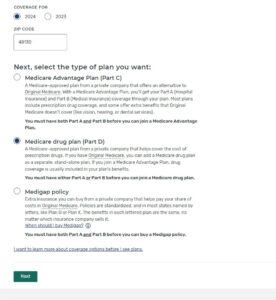

Just to clarify, I’m talking about Medicare Part D prescription (PDP) plans only. If you have Medicare coverage through an Advantage Plan, you may or may not have separate PDP coverage. If you have prescription coverage through retirement benefits, it may not be a PDP plan, either. But if you have standard PDP coverage, you’re in the open enrollment period now.

Some basic information

If you’re new to Medicare, or to Prescription Drug coverage, you may want to learn more about how PDP plans work. What is a formulary? A tier? Then there's the deductible, coverage gap (donut hole), and catastrophic coverage. Check out the embedded links to learn more.

Checking out other plans

(Screen shots below may be clearer using your Zoom function.)

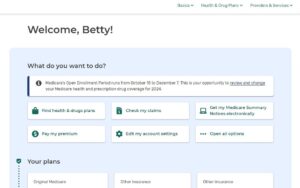

The easiest way for you to look at other PDP plans is to sign into your Medicare.gov account. When you use your own account, the information you enter will be saved. If you don’t have time to finish your research, you can log out and it’ll all still be there when you come back. Registering for an account is easy, and gives you access to many online features of Medicare. I highly recommend it!

Once signed in, you’ll be able to see your current coverage including your PDP plan. From there, simply click on the “Find Health and Drug Plans” button.

To individualize your search, you'll be asked to enter some information. Which pharmacies do you prefer to use? What medications do you take? Are you looking for a standard PDP plan or a different type of Medicare coverage? (Again, this blog post is referring specifically to the standard PDP plans.)

After you've entered the information, click the “Next” button at the bottom of the screen.

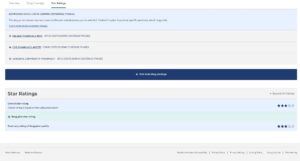

Now you’ll see all the available Part D plans in your area. The list can be filtered (organized) in a number of ways. Are you certain, for example, that you only want to do business with one or two specific companies? If so, you can choose which companies you want the system to display. If the most important thing to you is the monthly premium on the other hand, you can filter that way. There’s also total drug + premium cost, as well as annual deductible. Basically you can ask it to organize the results in a way that’s most important to you.

As an example I chose some medications that are problematic for many people, including a popular blood thinner and a couple of inhaled medications. I’ll use that sample list to show you how to get more details about the plans.

On the screen shot above, I can see that this plan carries a $5.30 monthly premium. Sounds great, right? Further, it’s telling me that the total drug + premium costs for all of 2024 is expected to be $2,845. Finally it shows a deductible of $280, which would be due at the beginning of the new year when prescriptions are filled.

But what if I want more detail than that? How much is the blood thinner each month? How much is each inhaler? To see that, click on the “plan details” button.

You’ll get a lot of information here. This page tells you which of the pharmacies you chose are “preferred”, “in network”, or “out of network” for this plan. Keep in mind every insurance company may have different contracts, so if your favorite isn’t on one list it might be on another. You'll also find the yearly cost for each medication, as well as the total annual cost for each pharmacy.

This is important -- scroll down just a bit too see if you're expected to reach the coverage gap (donut hole). If so, when? Will you get out of the coverage gap to reach catastrophic coverage? Just as important, what will the drug costs be by month? Some may remain the same all year long, but in the coverage gap some may go way up for several months. It’s good to be know what to expect before enrolling.